- #Incoming wire transfer fee verification#

- #Incoming wire transfer fee code#

- #Incoming wire transfer fee plus#

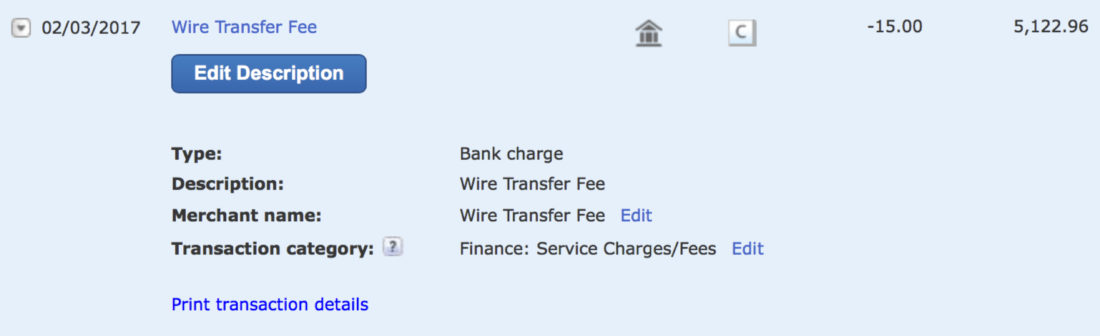

Follow the on-screen instructions to enter your payee details, payment amount, and when you would like the payment to occur (future-dated or recurring).Ħ. Expect a fee of 10 to be deducted from the total amount the sender transfers every time funds are wired to your Simplii Financial bank account.

#Incoming wire transfer fee verification#

Once you reach the Additional security step, generate the Transaction verification code.ĥ. While Simplii Financial does not charge a fee for incoming wire transfers, its parent bank, CIBC, does.

#Incoming wire transfer fee code#

When setting up a new wire payee, you will need to generate an additional code from your HSBC Security Device.If this is the first time you are making a payment to this recipient click New payee.For more information, view the Wells Fargo Wire Transfers Terms and Conditions.

Your mobile carrier’s message and data rates may apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. If you have made a payment to the recipient before, select the appropriate payee from your existing payees and click Continue. Enrollment in Wells Fargo Online Wires is required, and terms and conditions apply.In the To section below, select the Wires/Real-Time Payments option. On the Transfers, Wires, and Bill Pay page, select the HSBC checking or savings account from which you would like to transfer from.Within the Useful links bar, click Wires. No fees on incoming wires Used to make or redeem investments, remit or receive funds related to mortgage loans, and generally make or receive payments.Log on to Personal Internet Banking with a Security Code generated from your HSBC Digital Security Device or HSBC Physical Security Device.When you practice due diligence with regards to security, wire transfers can be an easy, convenient way to transmit money. If you are sending a wire in foreign currency, you should also pay attention to the amount of the exchange rate as the amount of the exchange rate can vary among providers. Familiarize yourself with the fees that apply to your wire transfer before initiating a transaction as the amounts vary depending on the provider, destination, mode of sending money, and amount of money being transferred.Take care to determine that a wire transfer is valid and appropriate as wires are final and cannot be canceled once the transfer is initiated.What else should I know about wire transfers? These methods are similar in terms of security. For a transfer made via a nonbank provider, a bank account number may not be necessary, but the provider will need the recipient’s name and the pickup location.

#Incoming wire transfer fee plus#

Most domestic transfers are processed on the same day, and international transfers are typically completed within a few days (depends on country).

0 kommentar(er)

0 kommentar(er)